How unethical practices in the global diamond industry affect you

Zeroing in on terrorist financing

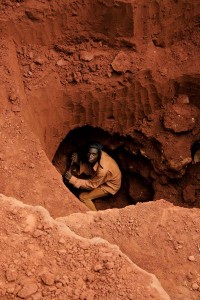

of their diamond resources.

PAC is not alone in its concern. Last year, a joint report by the African Development Bank (AfDB) and Global Financial Integrity (GFI), a U.S. research and advocacy group, concluded the illicit hemorrhage of resources from Africa is about four times its current external debt—or as much as $1.4 trillion between 1980 and 2009.

As South Africa’s ambassador to the United States pointed out on a panel we recently shared, this theft of Africa’s potential is largely the work of commercial interests headquartered outside the continent and action has to be taken in those jurisdictions to end this practice.

For the international law enforcement community, this activity spells a concern of a different kind.

The Financial Action Task Force (FATF) and the Egmont Group are two of the world’s leading agencies studying the issue of money laundering and terrorism financing. In 2013, they published a seminal study looking at the intersection between those threats and the diamond industry. Many KP members took part in the study, from North America to southern Africa, from Europe to the Middle East.

It makes for some stark reading, not least of which are its conclusions on the issue of transfer pricing in Dubai. Take for example the following excerpt: “Diamond trade centres like Dubai, which operate as free trade zones (FTZs), are susceptible to money-laundering vulnerabilities”¦This, in combination with the specific vulnerabilities of the diamond trade and the mechanism of transfer pricing, creates a significant vulnerability for money-laundering and terrorism-financing activities.” Â

As the report notes, by way of over- or under-invoicing with affiliate diamond companies located in free trade zones, it is possible to illegitimately shift profits from diamond companies in high-tax rate countries to FTZs and thus avoid taxes. The combination of a lack of transparency in the diamond trade with a lack of transparency in a free trade zone provides an excellent atmosphere to conduct large-volume transactions without being detected.

The report makes several recommendations, specifically targeting identified and proven vulnerabilities of the Kimberley Process. They cover everything from how to improve certification and enforcement to the lack of transparency and documentation by industry members.

The KP has yet to respond—never mind seriously discuss—this report’s findings. The response by most industry groups has been equally disappointing and dismissive. During the World Diamond Congress in Antwerp last June, most participants were largely ignorant of the report’s existence. By and large, and with a few exceptions outside of the big miners, some would argue the industry does a poor job of keeping abreast of, and proactively responding to, emerging threats. There is also a naïve belief the KP does everything it is supposed to do to protect the diamond trade.