Canadian diamond miner seeks “financial hardship” exemption from TSX

Special committee of independent directors supports exemption request in light of financial difficulty

Lucara Diamond Corp. says it has asked the Toronto Stock Exchange (TSX) for a “financial hardship” exemption to complete a $165-million private placement. The company says it needs the money because it is facing serious financial problems.

Lucara plans to sell more than one billion new shares at $0.16 each directly to select investors. The total money raised, $165 million, would help the company continue building its underground diamond project at the Karowe mine in Botswana. It would also help cover the cost of equipment, development work, and general costs.

The company needs the exemption because some insiders, including the Lundin Family Trusts, are buying a large part of the shares, and their participation is big enough that TSX rules would normally require a shareholder vote. After the financing, the trusts will own about 30.80 per cent of Lucara.

An independent committee of directors reviewed the company’s situation and concluded that the exemption was the only realistic option. Lucara has already exhausted its credit facilities and previously broke several loan rules, which were later waived.

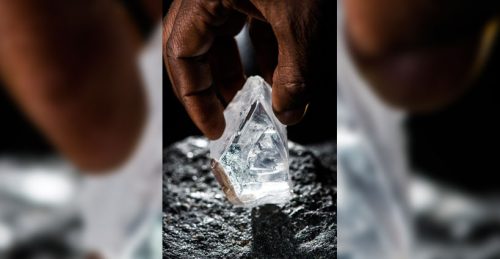

Lucara’s future diamond production depends on keeping the underground project on schedule. The company describes Karowe as a source of high‑value diamonds, and steady progress is important for future output.

The TSX will now review Lucara’s listing. The company says the financing is needed to avoid delays and keep its target of starting production in 2028.